Beer Styles by Country of Origin

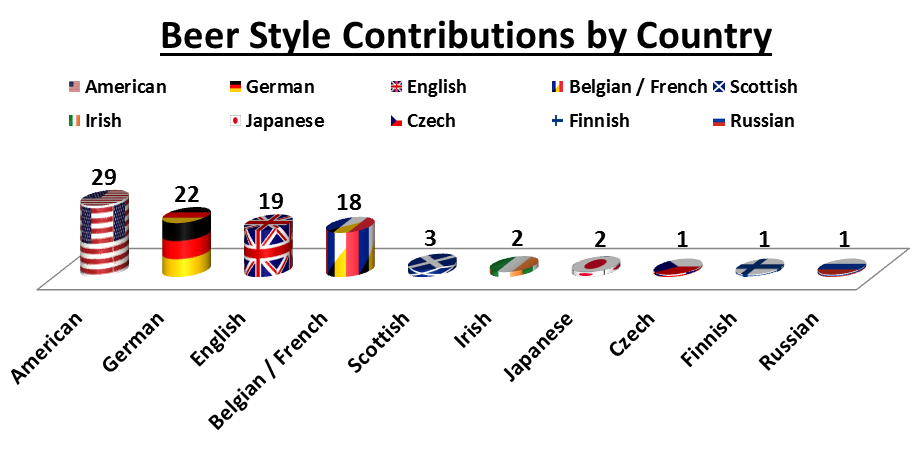

The following chart shows that the U.S. leads the world in total number of beer styles contributed with 29, followed by Germany at 22, The British with 19, Belgian & French with 18, the Scottish with 3, the Irish and Japanese with 2 each, and lastly the Czechs, Finnish and Russians each with 1.

As we can see above, there are more American beer styles than those native to any other country. However this fact alone does not explain why out of 104 different beer styles it is American beer styles that dominate the top 9 out of 10 positions in terms of commercial examples.

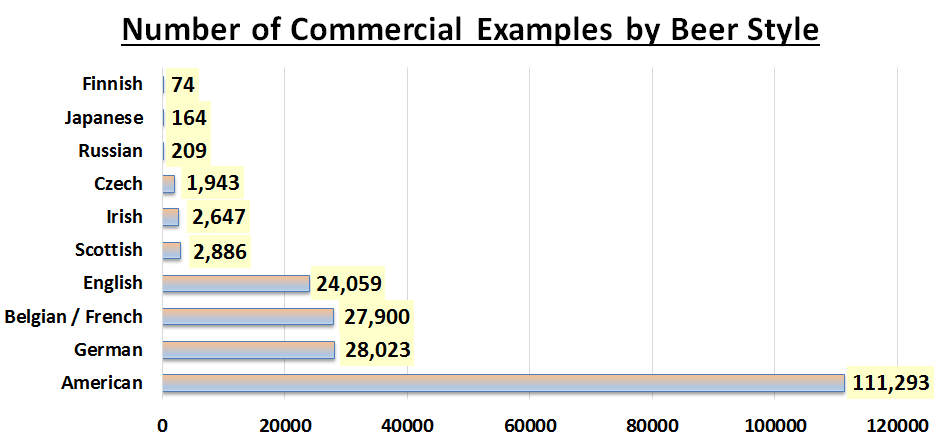

This apparent disproportion is even easier to see in the chart below that shows the total number of commercial examples by beer styles native to a given country.

As the chart above indicates, there are 111,293 commercial examples of American beer styles which represents 55.87% of the total number of commercial examples above. This means that the number of commercial examples of American beer styles are greater than all other non-American beer styles combined.

Considering that the number of commercial examples of the beer styles listed above may be affected by the number of breweries in that particular country, we next look to identify the total number of breweries in those respective countries in the following chart as per BeerAdvocate, Feb. 2018.

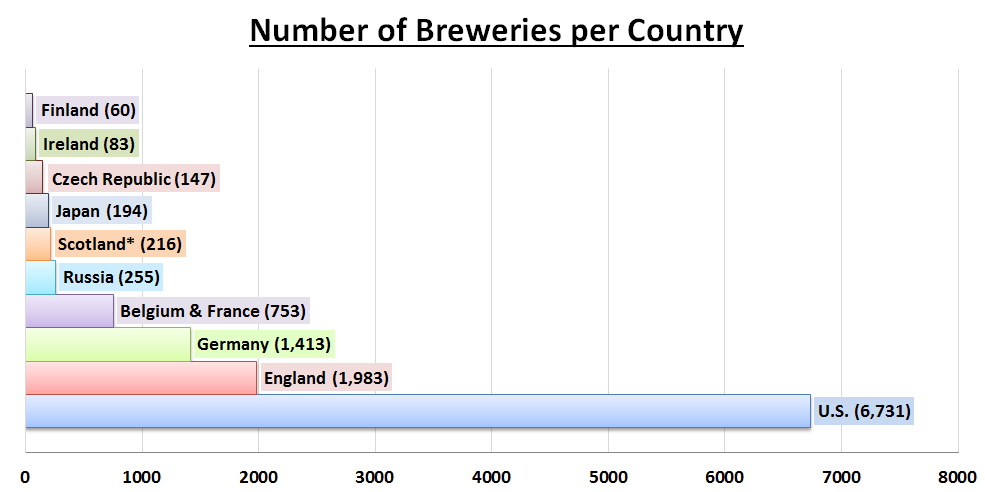

As suspected, the U.S. leads with 6,731 breweries, followed by England with 1,983, Germany with 1,413, Belgium & France with 753 ( 346 and 407 respectively), Russia with 255, Scotland at 216*, Japan with 194, the Czech Republic with 147, Ireland with 83, and Finland with 60. (* Scotland was separated from the U.K. in the chart above for illustrative purposes and is not currently an independent country.)

Adding up all the non-U.S. breweries on the chart totals 5,104, which is still less than the 6,731 breweries in the U.S. by a figure of 1,627 breweries. This means that U.S. breweries represent 56.87% of the total breweries listed, which is remarkably close to the percentage of commercial examples of American beer styles (55.87%) compared to the total number of all commercial examples of non-American beer styles.

From the number of breweries per country, especially in the U.S., we can begin to develop a stronger hypothesis for why U.S. beer styles dominate in terms of commercial examples— there are simply more breweries in the U.S. producing more commercial examples of American styles of beer.

Of course this begs the question: Is the U.S. really dominating, relatively speaking, after we account for the number breweries there are per country? Not necessarily.

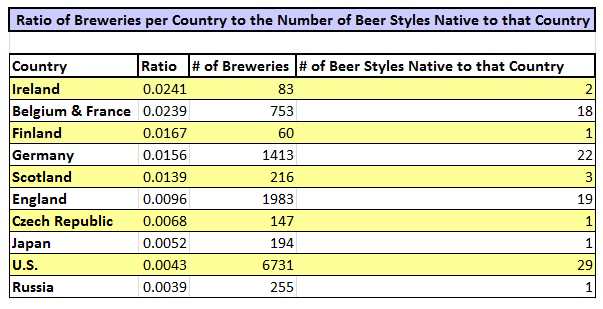

For example, when we look at the total number of breweries per country in comparison to the number of beer styles native to those respective countries, we see that the U.S. has actually produced relatively few beer styles as compared to most other countries as shown in the chart below.

Notice that relative to the number of breweries in the chart above, the U.S. is almost dead last in terms of the total number of beer styles contributed, sitting just above Russia.

However, it is more difficult to calculate the total number of commercial examples of a given native beer style relative to the number of breweries in its country of origin because different countries commonly produce commercial examples of non-native beer styles.

Take for example the Finnish beer style known as Sahti where only 10 of the 74 commercial examples listed on BeerAdvocate are actually brewed by Finnish breweries.

That said, the dominance of American beer styles in terms of commercial examples is strongly correlated with the number of breweries in the U.S. relative to other countries, which suggests that the volume of American beer styles may actually be on par proportionally with the volume of other beer styles native to the other countries listed above.

Cheers-

Next on tap: Data Chug: An Analysis of BeerAdvocate’s Top 250 Beers

[expand title=”Disclaimer: (Click to Expand)“]

While the data obtained from BeerAdvocate is taken at face value for the purposes of this analysis, one is well within reason to further analyze that source data in terms of the completeness of the listed beer styles, definitions of those styles, appropriate beer style grouping for the given commercial examples, verification of actual breweries in production, etc. In addition, considering that much of the data collected by BeerAdvocate is added by its users, one may further wish to question how that user group may affect the overall data (% of English-speakers, % of American users, etc.).

Also, the methods and parameters of data analysis herein are but one way of looking at the given information. Furthermore, all of the data collected from BeerAdvocate occurred in Feb. 2018, and therefore represents a single time-slice of the beer landscape, which of course is subject to change in the future.

Lastly, interpretation of the data above is up to the individual, for as the old adage goes, there’s more than one way to brew a beer.

[/expand]

Hi, I’m Dan: Beer Editor for Beer Syndicate, Beer and Drinking Blogger, Beer Judge, Gold Medal-Winning Homebrewer, Beer Reviewer, American Homebrewers Association Member, Shameless Beer Promoter, and Beer Traveler.

Pages: 12

Leave a Reply

You must be logged in to post a comment.